Ron Baron: His Net Worth, Tesla Bets, and Investment Strategy

Ron Baron's Tesla Optimus Claims: Genius or Just a Billionaire's Fever Dream?

Alright, so I caught Ron Baron on CNBC’s "Squawk Box" the other day, and let me tell you, it was a masterclass in talking your own book. The guy, a genuine investment legend with Baron Capital, spent a good chunk of airtime basically telling everyone the current tech selloff is like a clearance sale for geniuses. Investor Ron Baron says the tech selloff is an opportunity and he's never selling personal Tesla stake - CNBC And offcourse, his favorite bargain? Tesla. Again.

Now, I ain't gonna lie, Baron's got a track record. He started his firm back in '82, manages a cool $45 billion, and his flagship fund has been kicking the S&P 500's butt for years. He even got in on Tesla's IPO roadshow in 2010, then went all-in between 2014 and 2016, dropping $400 million. He's made, by his own estimate, eight billion dollars from Tesla. That’s not chump change. But here’s where my cynical meter starts redlining: he’s still holding every single one of his personal Tesla shares. Why? Because he made some decades-old promise to his mutual funds' board he wouldn't sell until clients sell all of theirs. So, it's not exactly a bold, independent vote of confidence when you're literally bound by a promise, is it? It's more like being tethered to a runaway train, hoping it's headed to the moon and not a cliff.

The Robot That Ate the World (According to Baron)

Here's where things get really wild. Baron isn't just predicting a modest uptick for Tesla. He's talking about a fivefold increase in his current $8 billion haul, pushing it to $40 billion in the next decade. He sees Tesla hitting $2,500 a share, potentially quadrupling to a staggering $10,000. Tesla could be a $10,000 stock in a decade, says longtime bull Ron Baron - Investing.com And what's the magic sauce for this astronomical leap? Optimus. Tesla’s humanoid robot. The one that, let’s be real, still mostly looks like it's trying to figure out how to walk without tripping over its own feet.

Baron, bless his heart, is drinking the Elon Musk Kool-Aid by the gallon. He claims Tesla is aiming for a million Optimus units next year, then ten million the year after. And Musk, the visionary, is apparently dreaming of one billion units annually, each costing around $20,000. One billion robots. Let that sink in. Where are these things going? Are they going to replace every single human on the planet? Is every household going to have a dozen Optimuses folding laundry and making artisanal coffee? I mean, who doesn't want "sustainable abundancy" and "light labor-saving," but the path Baron's laying out sounds less like a business plan and more like a fever dream hatched during a very expensive, very long dinner party. It’s like saying we’ll solve world hunger by breeding a billion unicorns that poop ice cream. Sounds great on paper, but the logistics...

And this is where the genius-or-fever-dream question really hits. Is it genius to see a future so far beyond our current comprehension that it just looks insane? Or is it just a billionaire with a massive stake in a company projecting his hopes and dreams onto the market, knowing full well that just saying these numbers out loud can move the needle? I'm leaning heavily towards the latter, but hey, what do I know? I'm not the one with $40 billion on the line.

Elon, the Key Man, and the Unasked Questions

Baron didn't shy away from calling Elon Musk the "ultimate 'key man' of key-man risk." No kidding. The guy's compensation is literally tied to massive company value growth, and his motivation, according to Baron, is legacy, not just wealth. He wants to put humans on Mars, for crying out loud. I get it. Big dreams. But what happens if this "key man" decides to get distracted by another shiny object, like, say, building a colony on Venus, or perhaps perfecting the art of sentient AI-driven meme generation?

Bank of America's analyst, Federico Merendi, recently bumped Tesla's target to $471, calling it a "leader in physical AI" with the biggest advantage in autonomous driving. That’s a far cry from Baron's $10,000 prediction, isn't it? It's like Merendi is talking about a car, and Baron is talking about a rocket ship to a new dimension.

Here's the thing: while Baron’s personal shares are locked up, Baron Funds actually sold 30% of its Tesla holdings a few years back. Why? "Client and media criticism regarding concentration." So, his own clients, the people whose money he's managing, got cold feet about the sheer volume of Tesla stock. That's a pretty big tell, if you ask me. It means not everyone is buying into the robot-apocalypse-turned-utopia narrative with the same fervor as Ron. Then again, maybe I'm the crazy one here, stuck in the mundane reality of what's actually possible in the next few years, while these titans of industry are already living in 2050. It’s a bad idea. No, 'bad' doesn't cover it—it's a gamble of epic proportions dressed up as inevitable progress.

The Emperor's New Robots

Look, I'm not saying Tesla won't do well. I'm not even saying Optimus won't eventually be a thing. But predicting a billion units at $20,000 a pop in the near future, leading to a $10,000 stock price? That's not just optimistic; it’s a level of magical thinking that makes me wonder if Baron's been spending too much time in Musk's rocket bunker. It’s a story designed to get headlines and keep the faithful invested, but when you peel back the layers, you’ve got to ask: are we really buying into this, or are we just watching a very rich man tell a very tall tale? My money’s on the latter. For now, anyway.

Just How Much Kool-Aid Are We Supposed to Drink?

Related Articles

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

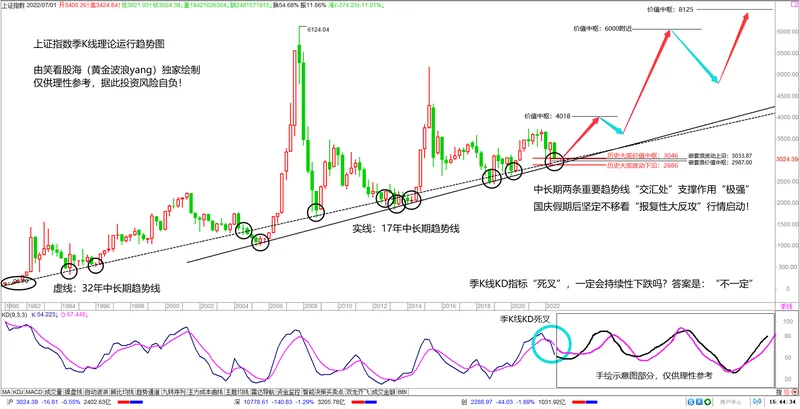

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

Hims Stock Surges 39%: A Data-Driven Look at the Surge

The ticker for Hims & Hers Health (HIMS) has been on a tear. A 39% surge in a single month is the ki...

QQQ: The Cash Flow Collapse No One Is Talking About

[Generated Title]: QQQ's Hidden Time Bomb: Are You Ready for the Nasdaq's Margin Meltdown? Alright,...

The QQQ Hype Train: What the big money is doing and why you should probably ignore it

So a mid-sized wealth management firm you’ve never heard of just plopped down nearly $5 million on a...