US Overtakes China in Africa Investment: What the Numbers Actually Say

The Quiet Reversal: Decoding the Data on US vs. China Investment in Africa

For years, the narrative has been set in stone: China is the undisputed economic heavyweight in Africa. Its Belt and Road Initiative, a sprawling network of infrastructure and investment, has been the dominant story. Any data analyst will tell you that a long-term trend is a powerful thing, difficult to reverse. Yet, the latest annual figures present a significant outlier, a deviation from the mean that demands a closer look, as detailed in How the US has overtaken China's investments in Africa.

The data, compiled by the China Africa Research Initiative at Johns Hopkins, is unambiguous. In 2023, US foreign direct investment in Africa reached $7.8 billion. China’s, by contrast, was $4 billion. For the first time since 2012, the US has retaken the lead. This isn’t a rounding error; US investment nearly doubled China's—to be more exact, it was 95% higher.

A shift of this magnitude doesn't happen by accident. It's the result of a deliberate, targeted, and state-directed strategy. And at the heart of it all is a global scramble for the very elements that power our modern world: critical minerals. The lithium in your EV battery, the cobalt in your phone, the tungsten in data centers—these are the new oil, and Africa is sitting on a vast reserve. China has long understood this, building a dominant position not just in mining but, more crucially, in processing. The US, having recognized its supply chain vulnerability, is now making a forceful play to catch up.

The Machinery of the Reversal

The primary instrument of this new American strategy is the US International Development Finance Corporation (DFC), a government agency established in 2019. The DFC isn't subtle about its purpose. Its own website frames its mission as a tool for "countering China's presence in strategic regions." This isn't your typical development aid; it's geopolitical capital allocation with a clear objective.

Consider the case of Trinity Metals, a mining company in Rwanda. Last year, the DFC provided it with a $3.9 million grant to develop its tin, tantalum, and tungsten mines. Shortly thereafter, Trinity began sending its tungsten to a processing plant in Pennsylvania and struck a deal for its tin to be sent to a smelter, also in Pennsylvania.

The company's chairman, Shawn McCormick, is on record stating the decision to supply the US was purely commercial and not influenced by the DFC's funding. And this is the part of the report that I find genuinely puzzling. As an analyst, I look for correlation and causation. The timing of this supply chain pivot, immediately following a government grant from an agency whose explicit goal is to secure supply chains, is… convenient. To claim the two events are unrelated strains credulity. Was the DFC grant a prerequisite for the US supply deal? Or was it simply a catalyst? The available information doesn't specify, but the correlation is too strong to be a coincidence.

This move is a microcosm of the larger US strategy. It's not about building bridges and dams anymore. It's about surgically targeting key nodes in the global supply chain for critical minerals and rerouting them away from China and toward the United States. It's a quiet, effective, and data-driven approach to geopolitics.

A New Partner, Not a New Paradigm

From the perspective of African nations, however, does the flag of the investor truly change the fundamental dynamic? Sepo Haihambo, a Namibian economist, offers a necessary dose of skepticism. She correctly points out that expecting the US to negotiate deals that prioritize Africa's best interests would be "unrealistic." The objective is resource security for America, not wealth generation for Africa.

This is the core of the issue. The competition between the US and China for Africa's resources is like two rival venture capital firms fighting over a hot startup. Both VCs will promise the world—capital, expertise, access to markets. But their term sheets are ultimately designed to maximize returns for their own limited partners (i.e., national interests), not to ensure the long-term, independent success of the startup. The founder—in this case, African governments—needs to read the fine print with extreme care.

Haihambo argues that African nations must move beyond simple "cash for minerals" deals. The real value isn't in the raw ore pulled from the ground; it's in the processing, refining, and manufacturing that follows. By simply exporting raw materials, African countries are exporting the most lucrative part of the value chain. She advocates for more sophisticated arrangements: joint ventures, local equity participation, and production-sharing agreements. These are the mechanisms that could allow nations to build sovereign wealth funds and invest in their own development.

The question is whether this new American push creates the necessary leverage for African countries to demand these better terms. When you're the only game in town, you set the rules. But when a well-funded competitor enters the market, the seller suddenly has more power. Will African leaders use this moment to rewrite the playbook, or will they simply accept a new offer from a different buyer?

The Data Points to a New Scramble

The numbers clearly show a change in the lead investor in Africa, but they don't yet show a change in the underlying game. The US has successfully deployed capital to achieve a strategic objective: securing access to critical minerals. It's a clinical, effective execution of industrial policy. But for Africa, this is simply the substitution of one foreign power for another. The continent remains a theater for a great power competition over resources. The shift from Beijing to Washington as the top investor is not a sign of a new, more equitable paradigm. It is, for now, just a change in management. The fundamental business model—extracting resources for foreign benefit—remains the same until African nations force it to change. The data on whether they can, or will, is not yet available.

Related Articles

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

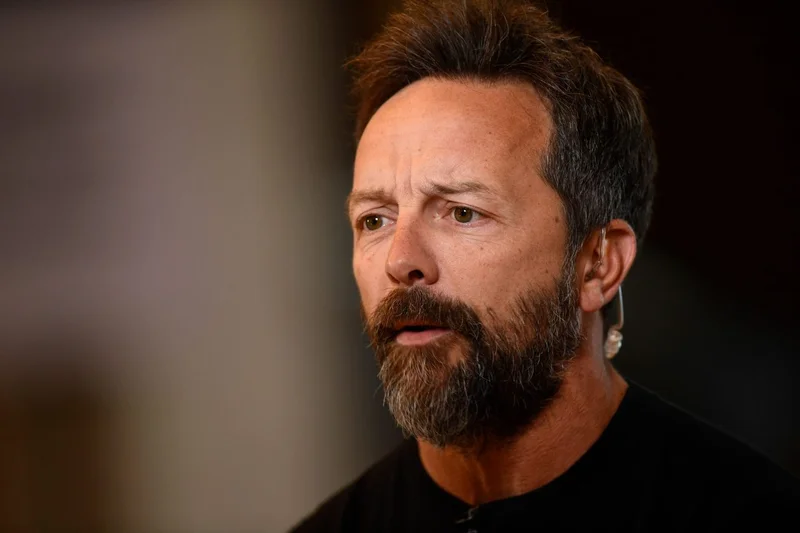

Brad Gerstner's Vision for the Next AI Titan: Why AMD's 'Bet the Farm' Move Could Change Everything

Every so often, a piece of news hits my desk that feels less like an update and more like a tectonic...

DoorDash Stock Tanks: Earnings Miss and What We Know

Alright, so DoorDash stock tanks 14% because they missed earnings and are suddenly gonna be "investi...

Cook County Property Tax: The Delays, Due Dates, & Your Second Installment

Cook County's Perpetual Loop: Another Tax Bill Delay, Another Operational Headache The news dropped...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...