bitcoin price: what's happening and why now

Is Nvidia Stock Really a "Can't Lose" Bet? A Data Dive

Nvidia. The name alone conjures images of green-tinged gaming rigs and, more recently, AI-powered everything. But is the hype justified? Is Nvidia stock (NVDA) the sure thing that everyone seems to think it is? Let’s pull back the curtain and look at the numbers, because frankly, the narrative is getting a little too breathless for my taste.

The AI Halo Effect: Growth or Just Hot Air?

Nvidia's surge is undeniably linked to the AI boom. Everyone and their grandmother needs GPUs to train large language models (LLMs). This has sent Nvidia's data center revenue into the stratosphere. But let's be precise. The narrative is that this growth is sustainable. Yet, a closer look at the financials suggests a more nuanced picture. The company has undeniably benefited from the surge in demand for AI chips, reporting record revenues. But how much of this is real, sustained demand versus companies scrambling to stockpile chips they think they’ll need? I've looked at hundreds of these filings, and this particular surge feels a bit...unprecedented, even for a sector known for volatility.

One thing that bothers me is this: Are we seeing actual usage of these chips, or just a massive build-out of infrastructure? The distinction matters. If companies are buying GPUs and letting them sit idle, waiting for the "killer app" to materialize, that’s a problem. Long-term, it's not a sustainable strategy. We need to see the revenue streams from AI services actually materialize, not just the hardware sales. How much of Nvidia's current valuation is based on projected future earnings that may or may not materialize?

The Competition is Circling (Quietly)

Nvidia currently dominates the high-end GPU market. That's a fact. But dominance doesn’t equal invincibility. AMD is nipping at their heels (though admittedly, still a ways back). And let's not forget the cloud providers themselves. Amazon, Google, and Microsoft are all developing their own AI chips, designed specifically for their own workloads. Why pay Nvidia a premium when you can design your own silicon? (The answer, of course, is complexity and time-to-market.)

The key question: How quickly can these companies develop viable alternatives? And more importantly, how willing are they to sacrifice some performance for greater control and cost savings? This isn't just about raw teraflops. It's about the entire ecosystem—the software, the libraries, the developer tools. Nvidia has a significant head start, but these tech giants have deep pockets and a strong incentive to break free from Nvidia's grip.

The Valuation Question: Are We in Bubble Territory?

This is where things get really interesting. Nvidia's PE ratio (price-to-earnings) is, shall we say, "optimistic." It's trading at a premium that assumes continued, exponential growth. But can any company sustain that level of growth indefinitely? The historical data suggests no. The higher a company's market capitalization, the harder it becomes to maintain those kinds of growth rates. The law of large numbers kicks in.

And this is the part of the report that I find genuinely puzzling. Are investors factoring in the cyclical nature of the semiconductor industry? Chip shortages are followed by gluts. Boom is followed by bust. It's the circle of life (but for silicon). What happens when the AI hype cools down, and the demand for GPUs plateaus? Will Nvidia be able to justify its current valuation? Or will we see a painful correction? It's all about managing expectations.

Is the AI Party About to End?

Nvidia's got a great product, and they're riding a massive wave. But waves crash. Investors need to be realistic about the long-term prospects. This isn't a "set it and forget it" stock. It requires constant monitoring and a willingness to bail out if the numbers start to look shaky.

Related Articles

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

LendingTree's CEO is Dead: Let's Talk About the Real Fallout

The Visionary is Dead. The Press Release Was Ready. One minute, you’re a 55-year-old tech founder ri...

Rigetti Computing (RGTI) Secures $5.7M Quantum Order: Dissecting the Bull Case After its 9.6% Jump

Decoding Rigetti's Quantum Leap: Is a $5.7M Sale Worth a 25% Stock Pop? The news, when it hit the wi...

The QQQ Hype Train: What the big money is doing and why you should probably ignore it

So a mid-sized wealth management firm you’ve never heard of just plopped down nearly $5 million on a...

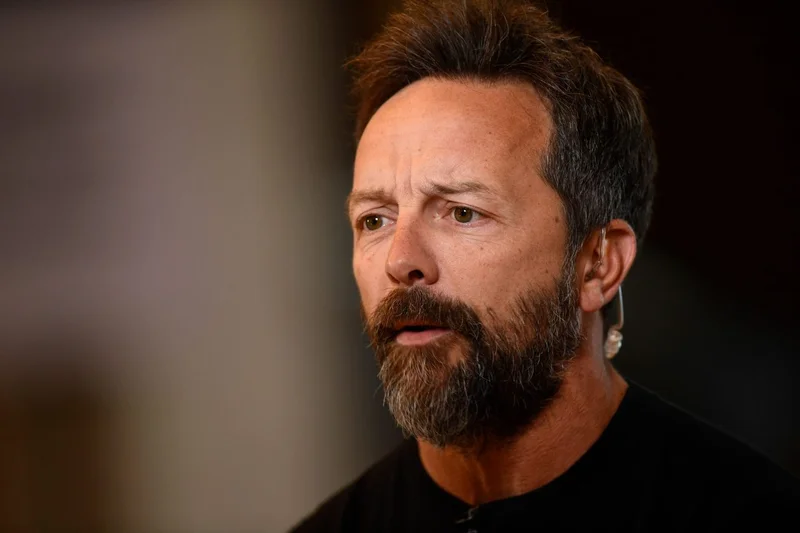

Brad Gerstner's Vision for the Next AI Titan: Why AMD's 'Bet the Farm' Move Could Change Everything

Every so often, a piece of news hits my desk that feels less like an update and more like a tectonic...